Gold has always been the fulcrum of economic activity and the financial system for most of mankind’s history, having been used as money as a medium of exchange in commerce and a store of value for savings. There are many reasons to own gold. Its safe-haven status and other attributes have benefited investor portfolios with a long-term allocation.

Gold’s Importance as a Strategic Asset

History has attested to gold’s unique attributes, making it an important and relevant asset from medieval to modern times. Its golden appearance is instinctively associated with wealth, quality, and desirability, and it is no wonder why membership cards, luxury products, and Bitcoin borrow the golden hue to exude these qualities.

Here are some attributes of gold that make it one of the best strategic assets to own in one's investment portfolio.

Gold is scarce

The shiny yellow metal does not originate from the Earth. It is not found in a leprechaun’s hidden pot of gold at the end of a rainbow. Rather, gold comes from outer space.

Gold is produced by nucleosynthesis, a process that fuses atoms of lighter elements into heavier elements, in the cores of stars, and is spewed into space by a supernova when stars reach the end of life.

Scientists believe that elements like gold were deposited on Earth during the planet’s creation or had arrived as a result of asteroid bombardment over its long history. Unless another asteroid hits the Earth, potentially causing mass destruction, our planet is not replacing gold that was mined throughout history.

Geological and mining data have shown that gold is rare in the Earth’s crust, making up only about 0.004 parts per million (ppm) by weight. By comparison, nickel and copper have a crustal abundance of 84 ppm and 60 ppm, which is why both metals are classified as base metals, while gold is a precious metal.

Gold is money

Gold’s scarcity is a reason for its use as money for most of humankind’s history, and its selection was not the result of any government decree but the free market’s consensus.

Merchants and other market participants accept gold as payment because gold fulfills the characteristics of money.

First, as previously mentioned, it was scarce, perfectly meeting money’s need for a limited supply. If money were not scarce, like rocks or sand on the beach, it would not be worth much per unit. Gold is highly valuable and cherished because it is scarce.

Second, gold is very durable and does not corrode like other metals. Archaeologists continue to unearth gold coins and artifacts from ancient times, and they are still in remarkable condition. In the same manner, money must be durable to withstand repeated usage and different storage conditions to be useful.

Thirdly, money should be divisible—capable of being divided into smaller portions to satisfy transactions of all amounts. Gold fulfills this criterion very well as it can be divided into smaller quantities, each having the same uniformity.

Fourthly, gold is very portable, allowing people to carry it as money in the form of gold coins or as valuables worn as gold jewelry.

Finally, money should be a store of value, meaning its value remains stable and does not decline over time. Gold’s stable value has been witnessed throughout history, even during periods of economic uncertainty. There has never been a time when gold was unloved or became worthless. On the contrary, gold continued to be cherished and became more valuable with paper currency debasement and the proliferation of leveraged financial products. Just as kings and pirates used to hoard gold in times past, modern central banks today are net buyers of gold.

Highly liquid

Due to gold’s desirability throughout history, its acceptability and value are well-recognized internationally. Gold has never been worthless, and anyone who rejects it does so out of ignorance of its value rather than as a problem inherent in gold.

The World Gold Council (WCG) describes the gold market as “large, global, and high liquid,” estimating that physical gold holdings by central banks and investors are worth approximately US$ 5.1 trillion.

Moreover, the WCG further stated that the gold market is more liquid than several major financial markets, including euro/yen and the Dow Jones Industrial Average, with trading volumes similar to the US T-Bills market.

Therefore, gold is highly liquid, regardless of whether you have gold bars or coins. This means that it can be sold easily at a moment’s notice to many market participants, like bullion dealers, jewelers, and pawnbrokers, who are interested in buying gold from you.

Gold’s liquidity is also due to its transparent international spot price, which provides transparency and allows market participants to make effective pricing decisions. With a transparent gold spot price, consumers can efficiently compare prices between multiple buyers or sellers of gold, giving them confidence to obtain the best offer.

Unfortunately, gold's high liquidity does not apply to all gold-related assets, such as gold stocks, gold funds, and other digital gold products. These depend highly on market conditions and may become less liquid in market downturns.

Furthermore, gold can be easily tested using non-destructive testing methods to ensure its authenticity.

Gold is no one’s liability

Many financial assets have counterparty and credit risk. A company’s stock carries a risk should the company go out of business. A bond carries a chance that the coupon or payment will be defaulted upon. In addition, the creditworthiness of the company or the bond issuer may be downgraded due to their performance or their counterparties’ actions.

For example, the subprime mortgage crisis in 2008 was the result of reckless lending to subprime borrowers. Borrower debt was then packaged into mortgage-backed securities (MBS) and sold as investment products to financial institutions, pension funds, and private investors. Unfortunately, the success of these MBS was dependent on subprime borrowers making repayments. The moment the repayments stopped and loan default rates skyrocketed, the entire counterparty chain unraveled, inflicting massive losses on MBS investors.

Fortunately, gold is no one’s liability and has no credit risk. Wealth put towards buying physical gold bars or coins immediately exits the financial system. When a repeat of the 2008 financial crisis happens, the value of the gold bullion is unaffected and insulated from any potential economic collapse.

The Dutch central bank, De Nederlandsche Bank (DNB), shared this sentiment when they put out this statement a few years ago:

“A bar of gold always retains its value, crisis or no crisis. Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again.”

How Gold Enhances a Portfolio

Investing in gold requires no specialized knowledge from a financial advisor, skills, or equipment. You are essentially buying gold, taking delivery, and storing it somewhere safe. Despite the simplicity of adding gold to your portfolio, the yellow metal brings with it many benefits.

Purchasing power preservation

The Classical Gold Standard's period of operation, from 1870 to 1914, was marked by economic growth, stability, and peace. Another hallmark was the stability of purchasing power, and inflation was only between zero to one percent.

Today, with currencies no longer pegged to gold, currency devaluation as a result of central bank money printing has consistently eroded the purchasing power of currencies. We witness ever-rising prices of goods and services and higher living costs.

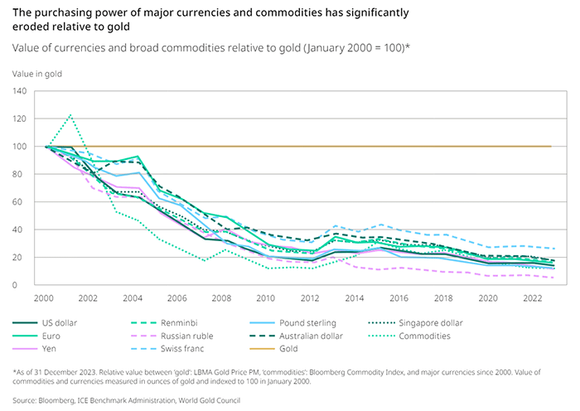

According to the World Gold Council, since the collapse of the Bretton Woods gold exchange standard in 1971, gold has significantly outperformed all major currencies as a means of exchange. Gold’s outperformance can be seen from the WCG’s chart below, even in the more recent past.

The collapse in currency purchasing power is to be expected since fiat money can be created in unlimited quantities to support monetary policy, while gold mine production has only grown by approximately 1.7% per year over the past 20 years.

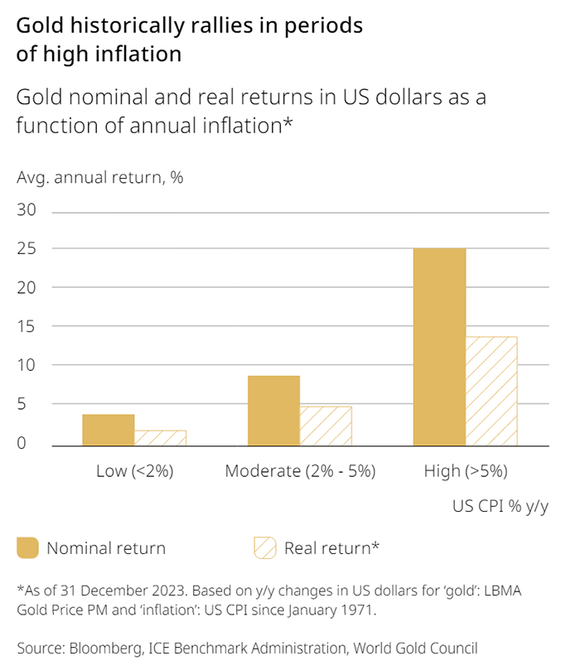

Effective inflation hedge

According to the Austrian School of Economics, inflation results from monetary supply expansion. As more currency units are created circulating the economy, with a corresponding increase in goods and services, price levels rise in response to the expansion of the money supply.

Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.. it can only be produced by a more rapid increase in the quantity of money than in output.”

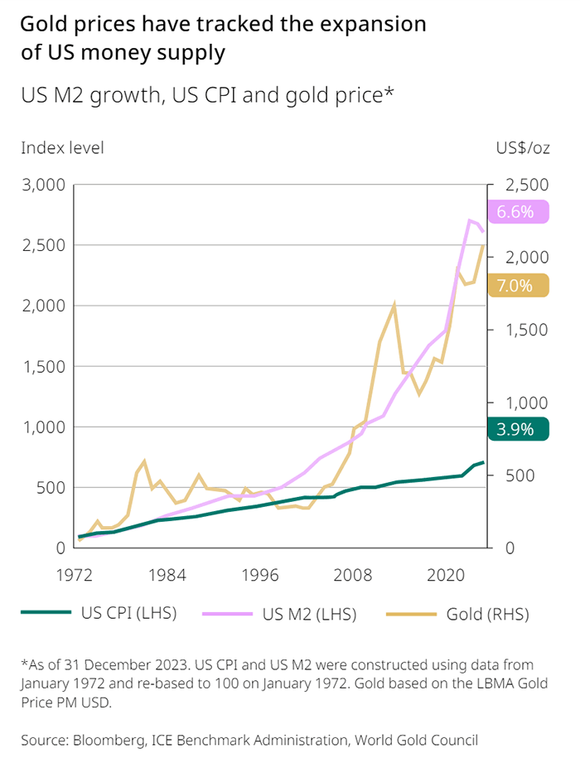

The World Gold Council chart below shows how gold prices have performed well and tracked the expansion of the US M2 money supply since 1972. M2 is a comprehensive calculation of the total money supply, including cash and other highly liquid assets that are not intended to be routinely used as cash. Considered as among the leading economic indicators, M2 is a critical measure in forecasting inflation.

World Gold Council data also showed that gold has outpaced the US and world consumer price indices (CPI) since 1971, the year President Nixon took the dollar off the Bretton Woods gold exchange standard. Gold in US dollars has increased by nearly 8% per year since 1971, even in years when inflation was between 2% and 5%.

Gold is a proven long-term inflation hedge, although it may not seem to be a perfect hedge in the short term due to price fluctuations.

Effective portfolio diversifier

Portfolio diversification is a financial strategy for mitigating investment risk by varying the asset classes or market sectors, limiting one's exposure to any type of investment. Overexposure to increasingly correlated assets can hurt portfolios significantly should the market go against the dominant investment strategy.

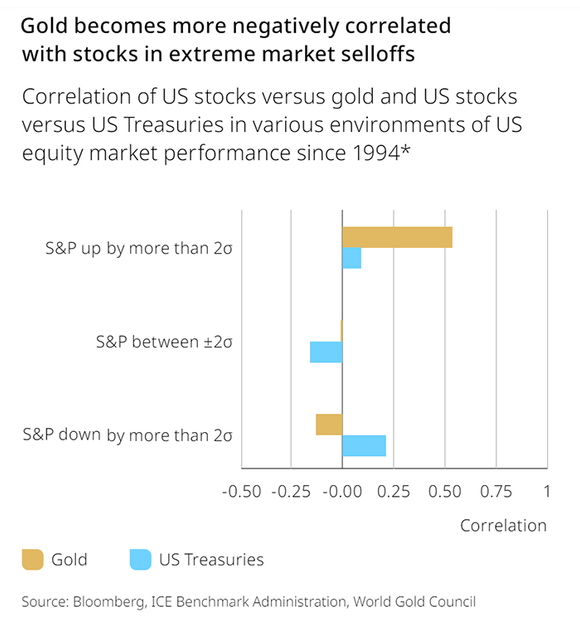

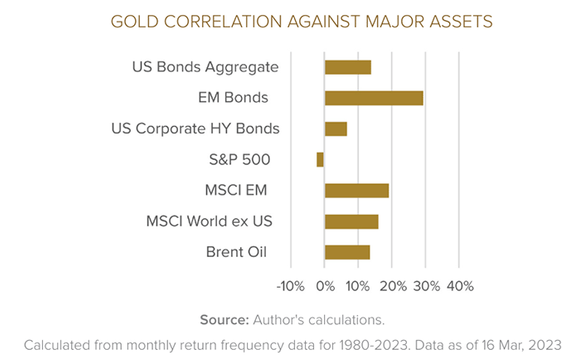

Different research has shown that gold has a negative correlation to equities and other financial assets, making it a great portfolio diversification option. In fact, gold’s negative correlation increases as these financial assets sell-off.

World Gold Council research compared the performance of the US stock market versus gold and US Treasuries in different environments of US equity market performance since 1994, as shown in the chart below. Correlation coefficients between 0.75 to 1 indicate a strong positive correlation.

Gold and US stocks are moderately correlated when the Standard & Poor’s (S&P) 500 weekly returns rise by more than two standard deviations. Both assets are slightly negatively correlated when the S&P 500 is between two standard deviations, and the negative correlation increases when the S&P 500 weekly returns fall by more than two standard deviations.

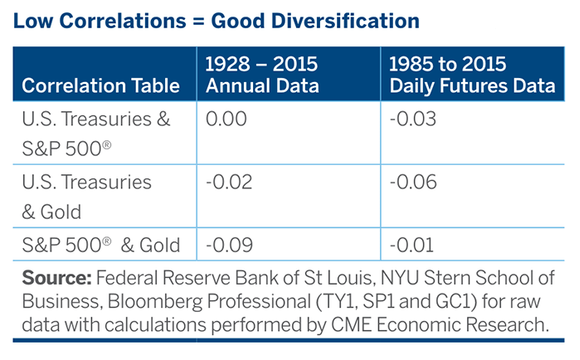

Research from CME Group from 2015 also concluded that “what makes gold attractive is that it also has a low correlation to both stocks and bonds and is thus a useful portfolio diversifier.”

The World Bank’s Gold Investing Handbook for Asset Managers, released in 2024, also found that gold “has very little to no correlation with other major asset classes,” making it a “valuable countercyclical asset in a portfolio.” It further states that gold’s correlation against major asset classes averaged below 30 percent and was even negative against the S&P 500 since 1980.

Finally, the physicality of gold, especially as gold bullion and gold jewelry, is itself an excellent diversifier from paper or digital assets. As mentioned earlier, physical gold does not carry counterparty risk – it cannot be defaulted upon, nor is its value dependent on the performance of any company or country.

Physical gold has other benefits. It cannot be hacked by cybercriminals. Unlike real estate, physical gold is highly portable, giving investors many options when owning gold in a diversified portfolio.

Investing in gold allows a diversified portfolio with other asset classes, like stocks and exchange-traded funds, to better mitigate market volatility and other market conditions.

Crisis insurance

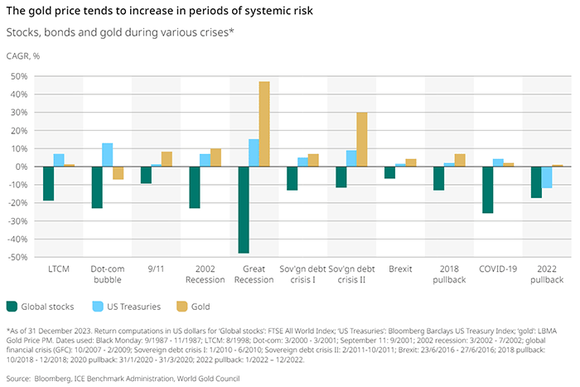

Gold has a dual nature as both an investment and a crisis insurance. While gold owners benefit from capital appreciation when the gold price rises, they are also protected during periods of systemic risk, like a banking crisis or a currency collapse.

Gold becomes crisis insurance when investors invest in gold and store it in a safe jurisdiction outside the financial system.

Moreover, World Gold Council data also revealed that the gold price tends to increase in periods of systemic risk, “delivering positive returns and reducing overall portfolio losses.”

The 1970s were a period plagued by high inflation, unemployment, and interest rates. In 1971, President Nixon severed the link between gold and the US dollar, ending the Bretton Woods system. The world was struggling to find its footing with an abrupt end to the world’s monetary system. In the midst of such uncertainties, gold rose a whopping 721% between August 1976 and January 1980.

As interest rates rose between 2004 and 2006, they fueled a boom in the US real estate market, ultimately culminating in the 2008 subprime mortgage crisis. Few realized how close the global financial system came to a total collapse then, as major banks and financial institutions faced bankruptcy and required government bailouts, sending shockwaves through the global financial system even through 2011. Between 2004 and 2011, gold rose by 400%.

Rising gold prices in times of crisis reflect capital seeking a safe haven flowing into the gold market. In addition to private investors, global central banks have also become net gold buyers since 2010. The timing of this switch was no doubt related to the 2008 Global Financial Crisis when the fragility of the US dollar Standard was exposed to the world.

The freezing of Russian foreign exchange reserves, some US$300 billion, by the United States and its allies further revealed a disincentive to over-rely on the US dollar. While the dollar is useful in global trade as the world’s reserve currency, any country’s dollar reserves risk being frozen should they not toe the line with the US. Suddenly, the dominant currency is not as safe anymore.

What options do central banks have to diversify away from the potential for the dollar to be used as a weapon against them? The only safer option is gold, as illustrated in Exter’s Pyramid. Gold is the ultimate neutral asset that is not monopolized by any country and is always internationally accepted.

This sentiment was echoed by Charles de Gaulle, former President of France, when he said, “There can be no other criterion, no other standard than gold. Yes, gold which never changes, which can be shaped into ingots, bars, coins, which has no nationality and which is eternally and universally accepted as the unalterable fiduciary value par excellence.”

Investing in gold and other physical precious metals is an excellent way to protect wealth from financial crises. Moreover, gold prices tend to rise as crises unfold, increasing the value of your investment portfolio and making gold an essential asset class.

Storing Gold Securely in a Safe Jurisdiction

Now that you have learned of the benefits of having gold in your portfolio, it is equally important to understand how gold can be stored safely to survive crises.

Given that many Western governments’ only solution to economic malaises is to print money for debt monetization, their mounting debts are becoming increasingly unpayable. Their options are to debase currency or to default on the debt.

If their fiscal positions were that of companies or individuals, bankruptcies would most certainly be their immediate fate. However, indebted countries are able to delay their inevitable bankruptcy due to their unrestrained ability to print money. Regardless, bankruptcy is certainly in their future.

History has shown that when governments face bankruptcy or a currency crisis, they have resorted to confiscating gold from private citizens to restore confidence in national currencies.

If you live in such countries, storing some gold in safer jurisdictions would be prudent, giving your wealth the best chance to survive the coming crises. We believe that Singapore is one of the few remaining countries in the world that is optimal for gold storage.

This conviction is the cornerstone of The Reserve’s sole establishment in Singapore. Well-known for its societal safety and strong rule of law, Singapore is one of the most welcoming cities for foreign investors and high-net-worth individuals to do business in and store wealth.

With 12,500 safe deposit boxes and 10 gold and art vaults for lease, The Reserve is the ideal wealth hub for clients seeking to store physical assets in Singapore's safe jurisdiction. You can buy gold and securely store it in your safe deposit box at The Reserve.

Only an 8-minute drive from Singapore Changi Airport, the busiest airport in Asia, The Reserve is extremely accessible to our international clients, who may want to access their safe deposit boxes quickly.

Contact us and speak with one of our wealth specialists to learn more about our wealth protection services in Singapore.