Le Freeport, formerly known as Singapore Freeport, is a secure storage facility in Singapore. While its original design caters to the fine art industry, such as international auction houses, art dealers, fine art logistics companies, and private collectors, Le Freeport also rents its premises to precious metals storage and high-value collectibles companies.

As the first secure storage facility in Singapore, built with direct airport access, that combined vaults and boutique-style showrooms, Le Freeport is a fascinating case study of how it became part of the country’s plans toward being a regional art hub. This article provides an overview of the developments of Le Freeport since its inception in Singapore and the challenges it faced in adapting to the changing landscape of asset storage.

The History of the Freeport Concept

Traditional freeports have existed for some time, serving mainly as temporary tax and duty-free storage for commercial goods in transit or waiting to be re-exported. They allow businesses to avoid paying customs duties and taxes unless the goods enter the domestic market of the host country.

Freeports are often located near major transportation hubs (airports, seaports, etc.) to facilitate easy movement of goods in and out. This reduces transportation and handling costs, making freeports highly attractive to businesses involved in global trade.

However, as the global economy progresses, increased wealth congealing within the ultra-high net worth class, with large pools of money needing new investment outlets, causes the demand for longer-term tax-free asset storage to rise.

For example, the 1888-founded Geneva Freeport, now officially known as Ports Francs et Entrêpots de Genève SA, historically operated as tax-free storage spaces for grain and other goods in transit.

After World War II, the function of the Geneva Freeport began to change as it became increasingly used to store luxury goods and high-value items, particularly art. This shift occurred in part due to Geneva's growing importance as a financial center, attracting wealthy individuals and businesses looking for secure storage options.

By the 1970s, Geneva Freeport had become an important hub for storing art and antiques, a trend driven by wealthy collectors, dealers, and auction houses. The legal protections, tax advantages, and strict confidentiality offered by Swiss law made it an attractive option for people looking to store valuable assets discreetly.

Often, these high-value assets were stored for indefinite periods of time, even though they were technically classified as “in transit.”

From the mid-1990s, the demand for high-value asset storage for unlimited periods of time spurred the push for Open Customs Warehouses (OCW). Unlike traditional freeports that cater to temporary storage for in-transit goods, OCW holds goods indefinitely without being subject to import taxes and duties as long as they remain within the warehouse.

Today, the term “luxury freeport” refers to the long-term storage of high-value art, antiques, and other luxury goods without paying the value-added tax (VAT), which ranges between five to fifteen percent in many countries. Beyond storage, luxury freeports also allow the trading of such high-value assets, a service rarely offered by OCW. Thus, these luxury goods may change hands while continuing to be stored in the same place, not seeing the light of day.

History of Singapore Freeport

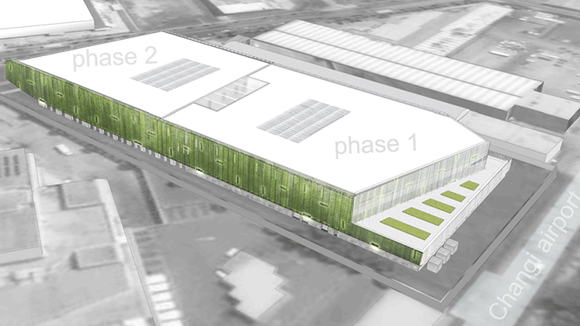

The construction of the 3-storey Singapore Freeport was planned to be completed in 2 Phases, with Boustead Projects Pte Ltd building Phase 1 for an awarded S$60 million. When completed in Q4 2009, Phase 1 would add 22,500 square meters. An additional 24,000 square meters would be added in Phase 2, which was slated for completion in 2014. However, Phase 2 did not materialize.

The Singapore Freeport opened in May 2010 on government land with direct access to Changi Airport runways to rapidly and safely transfer fine art and other valuables.

Among its founders was Yves Bouvier, a Swiss art dealer who was instrumental in transforming the Geneva Freeport into a depot for luxury goods and expanding the luxury freeport model, sometimes earning him the nickname “freeport king.”

Bouvier owned seven percent of the Geneva Freeport while the eight-seven percent majority shareholder was the Canton of Geneva. Gleaning from Bouvier’s experience and insights as a high-end art dealer, the Geneva Freeport began outfitting its premises with showrooms and offered services supporting the high-end art trade. These changes would become the blueprint for the Singapore Freeport and other similar facilities around the world.

With the Singapore Freeport, Bouvier, through his art services and logistics company, Natural Le Coultre, had sought the support of the Singapore government to build the facility.

During its initial years of inception, the facility had the support of Singapore government agencies such as the Economic Development Board and had the Singapore National Arts Council and the National Heritage Board among its shareholders. These government agencies are no longer shareholders as of 2011.

While the long-term storage and trade of high-value collectibles brought in from outside Singapore do not attract duties or the Goods and Services Tax (GST), Singapore’s equivalent of the VAT, the Singapore Freeport is not a free trade zone (FTZ). Instead, the facility is within Singapore Customs’ territory. [1]

The opening of the Singapore Freeport was in response to the rising affluence in Asia and the trend of the wealthy’s increased spending on “investments of passions,” such as collectibles and fine art.

The secure storage facility was positioned as part of the country's effort to attract wealth and become a regional hub for luxury collectibles. In keeping with its luxury position, an enormous 38m-long metal sculpture, aptly named “Cage Sans Frontières,” or “Cage Without Borders,” by Israeli designer Ron Arad fittingly fills the Freeport’s lobby.

The Singapore government’s interest in building the Singapore Freeport, sometimes nicknamed ‘Singapore’s Fort Knox for art and collectibles,’ likely coincided with its plans to revitalize the Singapore gold market and develop the country as a regional gold hub. Besides art and collectibles, gold bullion could be stored tax-free within a facility like the Singapore Freeport, attracting the importation and storage of precious metals.

The Singapore Freeport was renamed Le Freeport with the opening of the Luxembourg facility in 2016.

Developments and Controversies Over the Years

Christie’s Fine Art Storage Services (CFASS)

Christie's Fine Art Storage Services has been a tenant at the Singapore Freeport since January 2010. Owned by Christie’s International, CFASS rented approximately 40% of the Singapore Freeport’s Phase 1 22,500 square meter floor area. The company’s contract with the Singapore Freeport allowed the option to add capacity in the Phase 2 expansion of the Singapore Freeport.

On 12 June 2018, Christie’s sold all its shares in CFASS and is no longer a tenant of Le Freeport.

Storing Gold for Banks

In 2013, a year after Singapore exempted investment precious metals from its GST, Deutsche Bank, one of the world's largest gold dealers, was reportedly storing gold bullion in a vault at the Singapore Freeport.

During its initial years, the facility also stored gold for other banks: JP Morgan (2010), UBS Group (2013), and ANZ (2013). As of 2014, most of these banks are no longer customers of Le Freeport due to their exit from their physical commodity business. [2]

Impact of the Bouvier Affair

In 2015, Bouvier became embroiled in several international lawsuits that came to be known as the Bouvier Affair. These lawsuits were initiated by Russian oligarch Dimitry Rybolovlev, who had engaged the Swiss as the dealer for his art purchases since 2003, and were brought in courts in France, Monaco, the United States, Singapore, Hong Kong, and Switzerland.

Rybolovlev alleged that Bouvier had misrepresented and overcharged the works’ original costs. For example, according to court papers, the Swiss art dealer bought the “Salvator Mundi,” a painting now believed to be by Leonardo da Vinci, for $83 million in 2013 and sold it the next day to Rybolovlev for $127.5 million.

Rybolovlev’s lawyers claimed that their client was overcharged $1 billion for 38 separate art pieces over 12 years, a sum Rybolovlev reported said was “worth a Boeing” when French police questioned both of them [3].

For the lawsuit filed in Singapore, the High Court ordered a freeze on Bouvier’s assets globally in March 2015, forbidding him from removing assets worth up to $500 million from the country or disposing of any assets in or outside of Singapore. [4] Bouvier stepped down as head of Luxembourg’s Le Freeport the same year. In August 2015, Bouvier’s assets were unfrozen by the Singapore Court of Appeal.

In 2017, Bouvier sold his shipping and storage company Natural Le Coultre and was reportedly seeking a buyer for Singapore’s Le Freeport. The Swiss claimed that the ongoing conflict with Rybolovlev has cost him nearly $1 billion in lost business. [2]

In 2019, Bouvier commented that "attacks by Mr Rybolovlev against me in various courts and in the media have had a very negative effect on my business operations worldwide, including on the Freeport in Singapore." He had been selling assets amidst the legal brawl with the Russian billionaire. [5]

After what Bouvier described as a “nine-year nightmare,” the lawsuits were either dropped or reached confidential settlements by 2023. Despite the reprieve, Bouvier claimed that “the accusations have destroyed” his international art business. [6]

Sold to Chinese Crypto Billionaire

In 2022, Singapore’s Le Freeport was sold to Chinese crypto billionaire Wu Jihan for $28 million, a sharp discount to the $100 million cost to build the facility.

Bouvier had been trying to sell the facility, often dubbed Asia’s Fort Knox, since 2017. According to filings to Singapore's Accounting and Corporate Regulatory Authority, the Singapore facility was losing money, reporting a loss of $18.4 million by the end of 2018. [2]

A former Natural Le Coultre employee interviewed in a 2020 article revealed that the Singapore facility only managed to rent out “30-40% in terms of volume,” despite recalling countless official tours conducted for potential clients. [7]

An unsuccessful sale of Singapore’s Le Freeport in 2020 resulted in Bouvier suing the potential buyers, a group of businessmen. The defendants claimed that among their reasons for delaying the purchase was the freeport’s “bad physical and technological condition,” a claim rejected by a Bouvier’s spokesperson. [8]

What the Future Holds for Asia’s Fort Knox

The facility, now known as Le Freeport, opened to much fanfare in 2010 and was envisioned to play a major role in making Singapore a regional fine art hub. However, within a decade of its inception, controversies linked to one of its founders have undoubtedly taken some shine off the purported Asia’s Fort Knox for art.

While Le Freeport had a first-mover advantage in Singapore, it was not fully capitalized upon for a decade due to Bouvier's legal woes. During this time, the precious metals sector has emerged from a seven-year bear market and has since entered the early stages of a new bull market. This development has revitalized the bullion storage sector in Singapore, and new players, such as The Reserve, have entered the asset vaulting business, potentially competing in similar markets to Le Freeport.

Regardless, Le Freeport should continue to play an important role in Singapore’s luxury fine art industry, given the original Freeport concept. Its future is bright if it is competently managed, allowing the facility to reach its intended zenith in global art logistics and vaulting.

References

[1] MAS, “Singapore National Money Laundering and Terrorist Financing Risk Assessment Report,” 2013.

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Anti_Money-Laundering_Countering-the-Financing-of-Terrorism/Singapore_NRA_Report.pdf.

[2] The Business Times, “Singapore 'Fort Knox' said to be up for sale as Swiss owner fights Russian tycoon,” 2019.

https://www.businesstimes.com.sg/property/singapore-fort-knox-said-be-sale-swiss-owner-fights-russian-tycoon.

[3] N. Yorker, “The Bouvier Affair,” 2016. [Online]. Available: https://www.newyorker.com/magazine/2016/02/08/the-bouvier-affair.

[4] Reuters, “Singapore court orders asset freeze on 'Freeport King',” 2015.

https://www.reuters.com/article/world/singapore-court-orders-asset-freeze-on-freeport-king-idUSKBN0M90RH/.

[5] The Business Times, “Singapore 'Fort Knox' maximum-security vault said to be up for sale,” 2019.

https://www.businesstimes.com.sg/companies-markets/consumer-healthcare/singapore-fort-knox-maximum-security-vault-said-be-sale.

[6] Swissinfo.ch, “Swiss art dealer and Russian oligarch settle feud over collection,” 2023.

https://www.swissinfo.ch/eng/business/swiss-art-dealer-and-russian-oligarch-settle-feud-over-collection/49041942.

[7] Heidi.news, “Yves Bouvier's free ports halted in mid-boom,” 2020. https://www.heidi.news/explorations/the-fox-and-the-oligarch-the-incredible-bouvier-vs-rybolovlev-case/yves-bouvier-s-free-ports-halted-in-mid-boom.

[8] The Business Times, “Art dealer sues over failed Singapore freeport sale,” 2020.

https://www.businesstimes.com.sg/property/art-dealer-sues-over-failed-singapore-freeport-sale.