The World Gold Council’s Q2 2024 Gold Demand Trends revealed that Poland and India were the joint largest buyers of gold in the second quarter. Both countries added about 19 metric tons of gold to their gold reserves. The next largest gold buyer was Turkey, increasing its gold reserves by 14.63 tons.

The second quarter also marked a sharp decrease in central bank gold buying, falling 39% quarter on quarter to 183 tons. Regardless, the World Gold Council (WGC) considered Q2 central bank gold buying as “a very healthy level of buying” since it is still 3% above the five-year quarterly average of 179 tons.

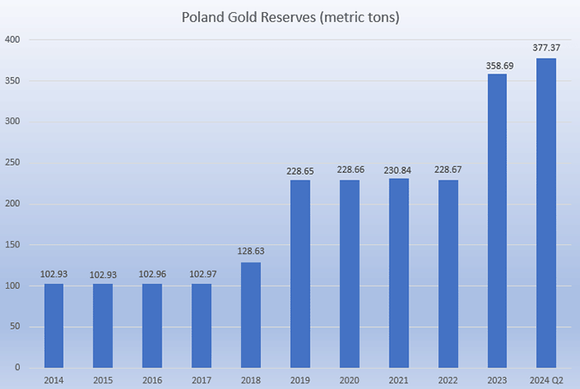

Poland Resumes Gold Buying

Poland’s Q2 increase in its gold reserves was its first purchase after its record gold purchase of 130 tons in 2023. The country's total gold purchased that year eclipsed its 100-ton purchase in 2019.

Adam Glapinski, president of Poland’s central bank, the National Bank of Poland (NBP), seems to be the main driver behind the country’s gold accumulation in these past few years.

Before Glapinski’s appointment in 2016, Poland’s gold reserves had stagnated at 103 tons for over a decade. However, they have steadily increased during Glapinski’s tenure at the Polish central bank.

By 2019, Poland had increased its gold reserves by 125.7 tons, an over 120% rise. The country climbed in ranking to become the country with the 22nd largest gold reserves, a marked improvement from its previous perennial 34th ranking.

That year, the National Bank of Poland also repatriated 100 tons of gold from the Bank of England vaults, preferring to store it on home soil. This gold was part of Poland’s gold that was sent abroad to the United Kingdom, United States, and Canada during World War II's outbreak.

However, the NBP continues to hold almost 124 tons of gold in the Bank of England’s vaults for opportunities to increase the profitability of official reserves through the placing of gold deposits on the interbank market.

In 2021, Glapinski published an article titled, ‘Investing for the long-term: gold as a pillar of NBP’s reserve management strategy,’ revealing his views about gold.

Glapinski writes:

As a public investor, NBP differs from a typical asset manager in that it holds a large investment portfolio, placing primary weight not on maximizing returns but on preserving liquidity and security of its endowment. The underlying idea is simple: if the FX reserves are not deployed to combat some financial stability or balance-of-payments emergency, they are to be preserved, preferably increased and passed on to another generation.

With such a strict investment mandate, it is perhaps no wonder that NBP considers gold as a special component of its official reserve assets. After all, the characteristics of gold are very well aligned with the precautionary role of maintaining foreign reserves and preserving capital in the long term, weathering periods of stress and varied market conditions.

Gold offers some unique investment features – it is devoid of credit risk, it is not easily “debased” by monetary or fiscal mismanagement of any country, and while its overall supply is scarce its physical features ensure durability and almost indestructibility. For all these reasons gold is considered as an ultimate strategic hedge.

The practical side of it all is that gold acts like a safe haven asset, in that its value usually grows in circumstances of increased risk of financial or political crises or turbulences. In other words, the price of gold tends to be high precisely at times when the central bank might need its ammunition most.

Glapinski also explained the central bank’s 2019 gold repatriation decision, saying that it was “aimed at reducing geopolitical risk, which could result in the loss of physical access to gold or a significant limitation of its free disposal.”

The NBP president ended the article promising a further increase of the gold reserves, “the scale and pace of which will depend on the official reserve assets dynamics and market conditions.”

Glapinski fulfilled this promise in 2023 when Poland increased its gold reserves by 130 tons. In the same year, he said:

“Why does the central bank own gold? Because it retains its value even if someone cuts off the supply to the global financial system. Of course, we do not assume that this will happen. But as the saying goes – fortune favours the prepared. And a central bank must be prepared for the most adverse circumstances. That is why gold has a special place in our currency management process.”

In May 2024, it was reported that Glapinski revealed plans to aggressively increase Poland’s gold holdings over the coming years. The NBP’s Q2 gold purchase of 19 tons looks to be the start of this new gold buying spree.

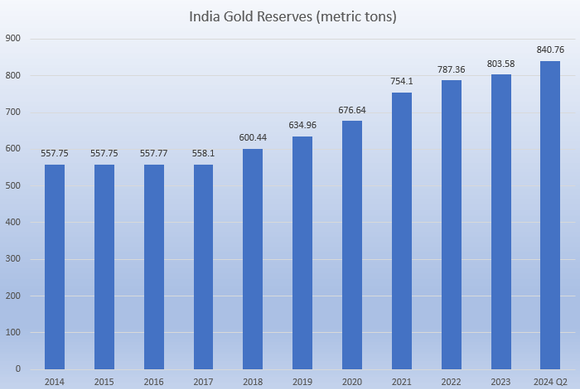

India’s Annual Gold Buying Trend Continues

Like Poland, India was the joint biggest buyer of gold in Q2 2024. It was also curiously similar to Poland in that it began adding to its gold reserves in 2016. Before that, India’s gold reserves had remained unchanged at 557.75 tons for seven years.

It is no secret that the Indians love gold. Indian households reportedly hold approximately 21,000 to 25,000 tons of gold or more than three times US gold reserves. Indian temple gold holdings are estimated at between 5,000 to 10,000 tons. Gold is more than a precious metal to the Indians. It is an emotion deeply ingrained in the identity of the citizenry and the nation.

Since 2016, India has been buying gold annually. According to World Gold Council data, India has the 10th largest gold holdings in the world, with 840.76 tons, as of August 2024.

Similar to Poland, India also opted to repatriate some of its gold from the Bank of England vaults. In May 2024, the Reserve Bank of India (RBI) transferred 100 tons of gold from the United Kingdom to domestic vaults.

Although RBI Governor Shaktikanta Das's official statement cited sufficient domestic storage capacity as the reason for gold repatriation, market observers speculated that recent geopolitical events, like the freezing of Russia’s foreign exchange reserves by the US and its allies, might have influenced the Indian central bank’s decision.

The repatriated gold is part of India’s gold reserves pledged to avoid bankruptcy during the 1991 balance of payments crisis.

In a recent interview, RBI Governor Shaktikanta Das said:

“If you see annually, we have been buying gold, that is because our priority is to diversify the deployment of our forex reserves in more currencies and in different kind of assets, particularly gold.

And if you look at the long-term price of gold, gold prices in the long run have always increased. They might have fallen in between, but in a long period average if you see the gold prices have invariably gone up.

So, therefore, gold is considered, therefore, as a kind of a permanent hedge that you can have against external uncertainties and challenges. So, therefore, we do buy the gold, but we naturally buy it whenever there is an opportune moment and there is a high level committee which decides the strategy of purchase of gold.”

Gold is the Ultimate Safe Haven Asset

It is clear that central bankers who have added gold to their national reserves consistently mention gold's historical role as the ultimate safe-haven asset to protect against geopolitical uncertainty and crises.

Before 2010, central banks were net sellers of gold. However, this has changed as central banks have become net gold buyers since 2010, with over a thousand metric tons purchased annually since 2022.

While the US dollar may still be the revered global reserve currency oiling the world economy, there are signs from particularly emerging market central banks that countries are hedging their bets for the future with gold.

Gold is widely regarded as a neutral asset. It flies no country’s flag and personifies intrinsic value. It is a counterparty risk-free asset that has been readily accepted for payment throughout history and will continue to be so in the foreseeable future.

Store Gold With The Reserve

While gold is undoubtedly a wealth protection asset, it is also important to store your gold and other precious metals with an experienced custodian in a safe jurisdiction. We believe that Singapore is one of the few countries best suited to offshore gold storage.

The Reserve is exclusively situated in Singapore, giving precious metal investors the best jurisdictional benefits for their gold storage. You can rent our safe deposit boxes to store gold, silver, and other valuables and have peace of mind knowing that our state-of-the-art security systems protect your assets.

Alternatively, you can rent personal safes and gold vaults with The Safe House, our resident vault with over a decade’s experience in precious metal vaulting and testing.

You can contact us for more information about storing gold at The Reserve.