As of 3Q 2023, Singapore has an external debt of USD $1.82 trillion, confirmed by the Department of Statistics Singapore. For a country with a total land area of 734.3 square kilometers, about 0.9 times New York City’s size, such a high amount of external debt must surely be disconcerting. It makes potential foreign investors wonder if the city-state is in as good a financial state as it has often touted to be. In this article, we demystify and explain the reason behind Singapore’s USD $1.8 trillion external debt.

What is a Country’s External Debt?

External debt refers to the total amount of gross external debt a country owes to foreign creditors. This debt can be owed by the government, corporations, or the private sector within the country.

It includes loans from foreign banks, foreign investments in domestic bonds and securities, and any other form of borrowing from foreign sources.

External debt is often denominated in foreign currencies, which means that the repayment obligations are subject to exchange rate fluctuations.

Why Does Singapore Have $1.8 Trillion of External Debt?

Given Singapore’s stature as a major international financial center, much of these gross external debts are debt liabilities in Singapore’s banking sector.

Like other major financial centers, Singapore receives a large inflow of foreign capital deposited with its banks. These deposits are recorded as external liabilities or borrowings. This is similar to how a bank records a deposit from a saver as a “loan” and, therefore, a liability on its books.

Conversely, when a bank lends out the money as a loan to a borrower, it is recorded as an “asset” on its books.

Similarly, foreign bank deposits are then lent to large overseas borrowers when they take up loans from Singapore-based lenders, becoming Singapore’s external assets.

If we consider the Net International Investment Position (NIIP), which is the difference between a country's external financial assets and liabilities, Singapore has a positive NIIP of USD $831 billion as of September 2023.

Therefore, Singapore is financially strong in its private sector. We will also address Singapore’s public sector debt later in this article, but for now, we will quickly point out that Singapore also has no net debt for its public sector. This is why Singapore has been accorded the highest ‘triple A’ credit ratings by the 3 major credit ratings agencies, Fitch, Moody’s and Standard & Poors, a strong testament to Singapore’s creditworthiness.

Comparing Net External Debt of Other Global Financial Centers

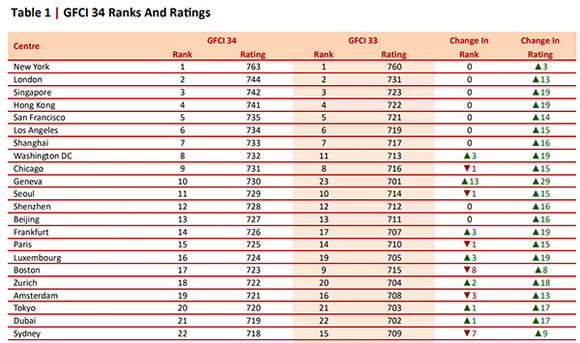

In September 2023, the thirty-fourth edition of the Global Financial Centres Index (GFCI 34) released its rankings for global financial centers based on competitiveness in the business environment, human capital, infrastructure, financial sector development, and reputation.

Singapore, as a financial center, was ranked 3rd behind New York and London.

Given that external debt differs in context between different countries, we will compare the Net International Investment Position (NIIP) and credit ratings (from Fitch, Moody’s, Standard & Poors), of the different countries where the global financial centers reside.

| Financial Center | GFCI 34 Rank | NIIP | Fitch | Moody’s | Standard & Poors |

| United States (New York) | 1 | -USD $18,160 bn | AA+ | Aaa | AA+ |

| United Kingdom (London) | 2 | -USD $863 bn | AA- | Aa3 | AA |

| Singapore | 3 | USD $831 bn | AAA | Aaa | AAA |

| China (Hong Kong) | 4 | USD $2,857 bn | A+ | A1 | A+ |

| Switzerland (Geneva) | 10 | USD $839 bn | AAA | Aaa | AAA |

| Germany (Frankfurt) | 14 | USD $2,945 bn | AAA | Aaa | AAA |

| Australia (Sydney) | 22 | -USD $ 548 bn | AAA | Aaa | AAA |

As we can see from the above table, Singapore has strong credit fundamentals, having the highest long-term credit ratings from all 3 credit rating agencies. In fact, Fitch Ratings’ affirmation of Singapore’s ‘AAA’ credit rating in July 2023 mentioned the following:

“Singapore's 'AAA' rating reflects its exceptionally strong fiscal and external balance sheets, large general government and current account surpluses, high income per capita, prudent macroeconomic policy framework and favourable business environment. Singapore's large positive net international investment position (IIP) equivalent to 176% of GDP, according to IMF data, is a key credit strength.”

Therefore, there is more than meets the eye with Singapore’s USD $1.8 trillion external debt. When examined in perspective and with the right context, articles or external debt rankings painting Singapore as a highly indebted country belie the city-state’s true financial strength.

What About Singapore’s Public Debt?

Singapore's debt, public or national debt, is also often misunderstood. On public debt rankings, Singapore has been ranked 4th by the CIA World Factbook, 5th by the International Monetary Fund (IMF), 6th by the World Bank, and 7th by the United Nations. Moreover, the World Debt Clock website shows Singapore’s national debt as having a debt-to-GDP ratio of 174%.

Looking at these rankings and debt-to-GDP ratios is very misleading, and it causes people to think that Singapore is one of the world’s most indebted countries, in the company of really indebted countries like Eritrea, Barbados, Lebanon, Burundi, and Greece.

The truth is that Singapore has no net debt. The Singapore Government is constitutionally required to run a balanced budget over each 5-year government term – always spending equal to or less than what the government earns or receives.

Similar to how Singapore’s external debt is misunderstood when one looks only at the liabilities of a balance sheet, many observers are concluding that Singapore has high government debt by only considering the gross debt or liabilities of Singapore’s public debt.

When Singapore’s assets are also considered, the nation has no net debt and is a net creditor country.

Singapore Borrows Internally to Reinvest, Not Spend

Moreover, Singapore’s public debt is not a result of the government borrowing for expenditure. This is forbidden by law under the Government Securities Act.

Rather, the borrowed sums are owed internally to residents, the Central Provident Fund, and the Monetary Authority of Singapore when they buy Singapore Government bonds such as the Singapore Government Securities (SGS), Special Singapore Government Securities (SSGS), and Singapore Savings Bonds (SSB).

These Singapore Government bonds serve different purposes by design. For example, the Singapore Government Securities are issued to develop a liquid domestic debt market. The Special Singapore Government Securities are non-tradable bonds issued specifically to the Central Provident Fund (CPF), Singapore's national pension fund, providing returns to grow retirement funds. The Singapore Savings Bonds are non-tradable bonds that provide a long-term saving option for individual investors.

The monies from these Singapore Government securities are then invested with Singapore's Sovereign Wealth Funds for inflation-beating returns. Therefore, Singapore does not borrow to finance spending that adds to government debt. Instead, the borrowing proceeds are reinvested for growth. This is unlike other countries that may issue treasury bills to raise funds for nationally significant infrastructure and other government spending needs.

Therefore, Singapore is fiscally sustainable, has a strong balance sheet, and has no net public debt, an uncommon feat among nations today.

How Strong is Singapore as an Investment Destination?

Singapore’s financial strength is the result of common-sense policies enacted by its government. Despite the country's wealth, the Singapore Government has had an excellent track record of being prudent with the country’s finances and spending wisely in areas that benefit the country most.

The city-state is known to punch above its weight internationally, having received top rankings in global indices for economic competitiveness, safety, corruption, political stability, workforce skill, and quality of life.

For example, Singapore has been ranked first in EIU’s business environment rankings for 15 consecutive years. World Bank’s Logistics Performance Index 2023 ranked Singapore as the world logistics champion. Singapore is the 5th least corrupt country according to the Transparency International Corruption Perceptions Index 2022. In the Global Innovation Index, which assesses a country’s technological infrastructure and innovation capabilities, Singapore is ranked 5th in the world.

Beyond Singapore's economic achievements, the country also possesses a mid-sized military for its defense, built from a defense budget thrice that of its closest neighbor. The Singapore Armed Forces (SAF) is capable of deploying 420,000 personnel at short notice and has an air force comparable to that of Germany. Given Singapore’s limited land area, the SAF has adopted a strategy to spread its military assets across bases in allied countries such as Australia, Thailand, New Zealand, and the United States.

However, using military force is the last option. Rather, Singapore actively maintains friendly relations with many countries, using diplomacy to achieve peace. It is one of the few countries that maintains good relations with the United States and China.

Singapore’s well-rounded strengths make it an ideal destination for investors, as testified by the USD $1.8 trillion of capital inflow forming its external debt.

Singapore’s Strength Augments The Reserve

History has shown that governments tend to consider confiscating residents’ physical assets, including precious metals, in times of national bankruptcy. Today, many Western nations are heavily in debt. Chief of these debtor countries is the United States, which is unlikely to be able to repay its massive debt. A debt default followed by a currency collapse is likely on the horizon. When this happens, silver and gold confiscations by the government are likely to rear its head again.

Physical precious metals like gold and silver are proven and time-tested stores of wealth throughout history. Gold or silver bars stored outside the financial system allow one’s wealth to survive black swan events or severe financial crises, but only if stored in the most secure way possible.

The Reserve, built by the Silver Bullion, is located in Singapore to tap into the above-mentioned jurisdictional advantages of the country. Its in-house vault, The Safe House, provides one of the safest ways to store precious metals in Singapore, one of the safest countries in the world. The bullion bars and coins stored in our vault are fully covered by our unique insurance policy that even protects against any losses from mysterious disappearances – a form of coverage insurance underwriters only grant to companies assessed to have fulfilled the highest standards of security by insurance inspectors.

When you store wealth at The Reserve, you have peace of mind knowing that your wealth is truly secure and protected by the laws of Singapore, one of the world's most financially strong and stable countries.

The Safe House's silver vault